Unlike Traditional Dividend Strategies that Focus on the Past or Present, DDGS Focuses on the Future

Our proprietary research process prioritizes free cash flow and financial prudence, the keys to identifying the best-run businesses. Via an active management approach, DDGS invests in companies most likely to produce, sustain, and increase payouts.

Higher Yields+FasterGrowth = Larger Cash Flow Tailwind for Investors

Projected Pre Tax Dividend Payment by Year of an Initial $ 250K Investment with Dividends Reinvested at Historical Growth Rates at Current Dividend Yield

No Data Found

Source: Bloomberg, Interactive Broker Report

Projected After Tax Dividend Payment by Year of an Initial $ 250K Investment with Dividends Reinvested at Historical Growth Rates at Current Dividend Yield

No Data Found

Source: Bloomberg, Interactive Broker Report

Notes

1. Dividend Durable Growth (DDG), MSCI All Country World Index (ACWI), and S&P Global Dividend Aristocrats Index (WDIV)

2. DDG Yield assumed to be 2.86% with a historical growth rate of 10%.

3. The WDIV Yield estimated at 5.58% with a historical growth rate of 3.02%.

4. The ACWI Yield estimated at 2.17% with a historical growth rate of 1.99%.

5. The yield of the 30-year US Treasury Bond is assumed to be 4.34%.

6. The tax rate on dividends is assumed to be 20%, while the tax rate on bond income is assumed to be 40%.

7. Dividends are assumed to have been reinvested at historical growth rates

This gives investors tremendous staying power in a strategy even in flat or down markets and is a condition that has historically led to outperformance on a Total Return basis.

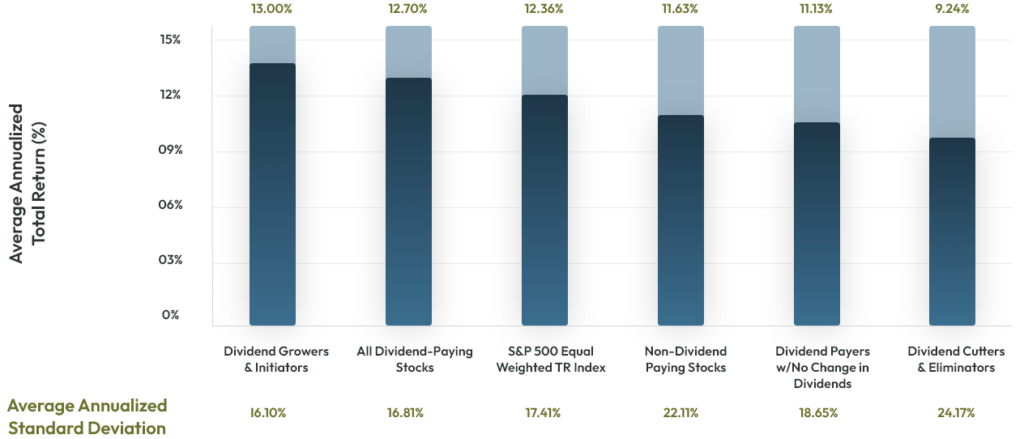

More Prominent, Expanding Cash Flows have Resulted in Equity Outperformance

S&P 500 Index: Returns and Volatility

January 31, 1973 to September 30, 2024

No Data Found

Source: Ned Davis Research, Inc.

Past performance is not a reliable indicator of future performance. For illustrative purposes only. It is not possible to invest directly in an index.

Source: Copyright 2023 Ned Davis Research, Inc. Further distribution is prohibited without prior permission. All Rights Reserved.

Reinvestment and compounding of sustainable dividend streams have led to equity outperformance.

Over 50 years of data provides compelling evidence that an equity portfolio anchored by a ‘Dividend Grower’ allocation can potentially lead to superior, long-term performance and optimal risk metrics.

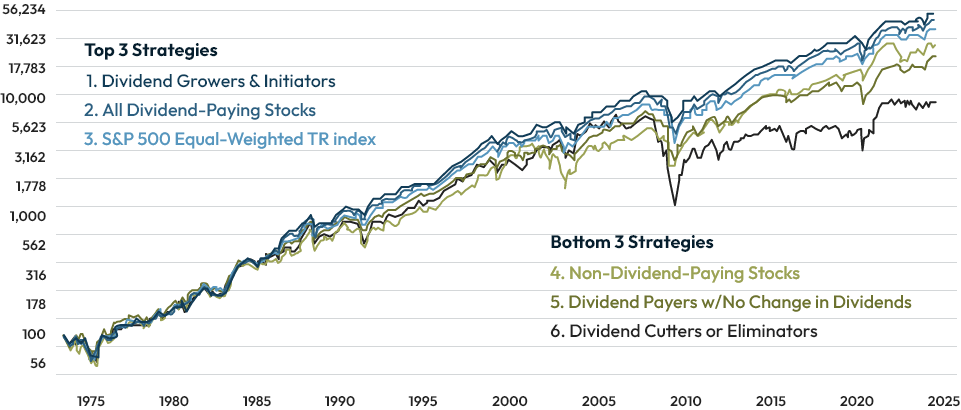

Over the Long-Term, We Expect Dramatically Superior Performance via Dividend Growers

Returns of S&P 500 Stock by Dividend Policy (January 31, 1973 to September 30, 2024)

Source: Ned Davis Research, Inc., Refinitiv, S&P Dow Jones Indices

All indices are allocated to start at 100.

Dividend policy indices are equal-dollar-weighted with monthly rebalancing

DDGS believes the financially fittest, most sustainable companies distribute increasing cash back to shareholders.

We believe in compelling, long-term data supporting a ‘dividend growth’ investment philosophy. Now, via DDGS’ actively managed, proprietary investment strategies, we believe investors can optimize their access to those best-run businesses prioritizing free cash flow and financial prudence.